SPEAK TO ONE OF OUR LIFE INSURANCE EXPERTS

FILL OUT THE FORM BELOW

LIFE INSURANCE BENEFITS

cash value growth

Compounded cash value growth is the increase in an investment's value over time. In life insurance, it refers to the tax-deferred accumulation of value within a policy.

death benefit

A death benefit is the amount of money paid to beneficiaries upon the policyholder's death in a life insurance policy.

liquidity

Liquidity refers to how easily and quickly an asset can be converted into cash without significantly affecting its value.

free from probate

"Free from probate" means that certain assets can be transferred to beneficiaries without going through the legal process of probate, which can be lengthy and costly.

Tax free advantages

Life insurance offers tax advantages, such as tax-free death benefits to beneficiaries and tax-deferred growth of the policy's cash value

flexibility

Life insurance flexibility refers to the ability to adjust various aspects of the policy, such as premium payments, coverage amounts.

Living benefits

Living benefits are features of a life insurance policy that allow the policyholder to access funds while still alive in cases like chronic or critical illnesses.

nexgen wealth

Next Generation Wealth merges cutting-edge technology with personalized, sustainable investment strategies.

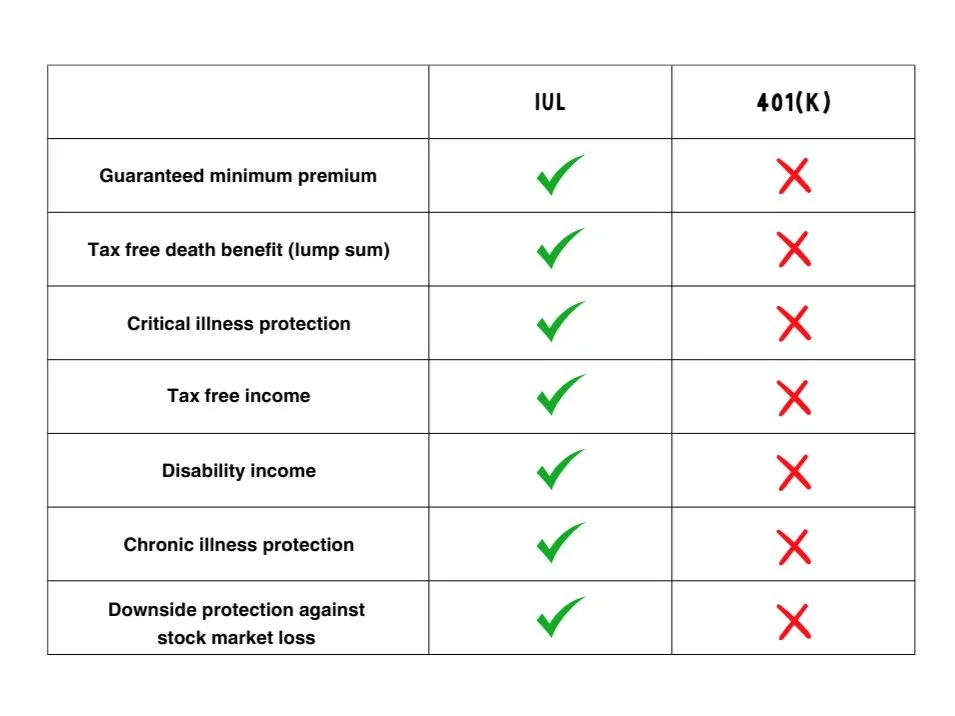

IUL VS 401K

Greater flexibility in premium payments and death benefit options compared to a 401(k)

Tailor coverage to fit changing financial needs and goals

No need to wait until a specific age to access funds

Freedom to use your money without seeking permission

Financial Security Plus Wealth Accumulation To Make Your Golden Years, A Little More Golden!

FAQs

-

IUL is a type of permanent life insurance that provides both a beath benefit to your beneficiaries and a cash value component that can grow based on the performance of a specific stock market index, like the S&P 500. Unlike direct investments in the stock market, your cash value has the potential to grow with the market and with a degree of protection against loss. Your premiums are flexible, allowing you to adjust them based on your financial situation.

-

Step 1: Fill out the form above

Step 2: Schedule an intro call with one of our licensed specialist

Step 3: Build a custom illustration with our licensed specialist

Step 4: Fill out application and apply with the carrier

Step 5: Get approved and make your first premium

-

Approval for an IUL is just an application process and most of the time exam free underwriting. The approval time can vary depending on the carrier. Some carriers have instant decisions while

-

Item descripMax funding your Indexed Universal Life (IUL) insurance policy can provide numerous benefits, including accelerated cash value growth, enhanced death benefit protection for your beneficiaries, tax-advantaged growth, greater flexibility and control over your policy, and alignment with long-term financial planning goals. By contributing the maximum allowable premium payments, you can potentially optimize the performance of your policy, capitalize on market growth opportunities, and build a valuable asset that supports your financial security and legacy planning objectives.